Former African students work as traders on the 7th Km Market.

Right: The 7th km: Pink street after closing time.

The 7th km: night-time wholesale trade.

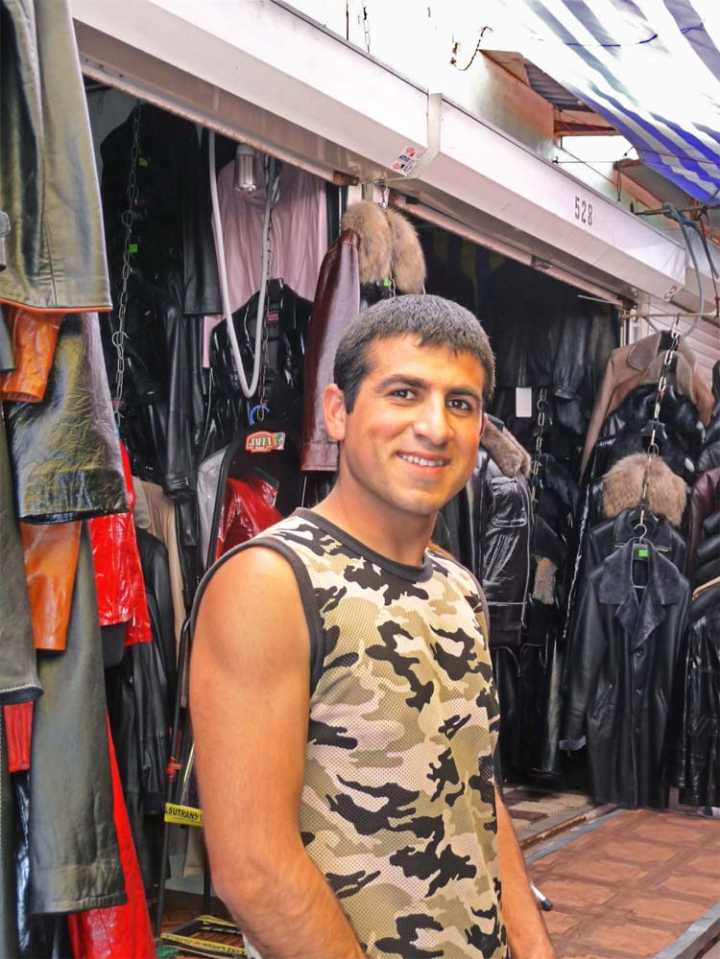

A Turkish trader selling Turkish leather goods.

Right: A Vietnamese money changers' corner.

Sociality on the market: a shared meal after work.

Locals and the mass media often refer to Sedmoi as a ‘state within a state’. If it is a ‘state within a state’, it is one that is surprisingly easy to enter. The market is not surrounded by a wall or protected by anything beyond a fence and it asks no questions about the nationality, visa or asylum status of people coming in either as traders or purchasers. However, the Ukrainian state boundaries are another matter. The purchasing hordes do face certain slightly tricky moments when they return across international frontiers with their great bundles, for protectionist policies are still the preferred way of encouraging local business. In this situation large firms have to pay duties, but for the crowds of individual purchasers, as Polese observed on the train running between Odessa and Chisinau in Romania (2007: 9), trade and smuggling are essentially indistinguishable. Well-established routines with the border-guards ensure that the goods pass through and the guards are satisfied.

Setting up as a trader at Sedmoi avoids taxes, duties and licenses. All one needs is connections and/or money. The containers may be bought as ‘real-estate’ – their price shot up from around USD 1,000 in the late 1990s to $240-250,000 in 2007 – and then franchised out to employees. These employee managers then hire sellers (‘realizatory’) on a day-to-day basis to retail the owner's goods. One seller told us she received 3% of the profit on everything she sells and returns the items she does not sell. It is quite easy to obtain such dead-end work. The other model is to rent a container from a boss in order to set up one’s own separate trading business. In this case, the renter is responsible for obtaining the goods as well as selling them. This is a riskier path – huge loses can be made, as well as great profits. Now certain payments are made by all owners/bosses to the central administration of the market, and an uncertainty hangs over whether these payments should be conceptualised as tax or rent. But what is clear is that the normal taxes, imports, town rates, licenses, etc. of the surrounding Ukrainian state are almost entirely in abeyance within Sedmoi. It is up to the individual traders to comply (or not) with such regulations. The Deputy Director of Sedmoi has been quoted as saying that the market’s owners pay roughly $11 million per year in federal and local taxes – a contribution which is disputed by the Odessan city authorities – but as for the income and other taxes and customs duties of the vast army of traders, that is not his business. “We never tried to control it,” he said. “We are not the tax authorities” (Myers 2006). Evidently, this is the main reason for the low prices to be found at Sedmoi.

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...

read more...